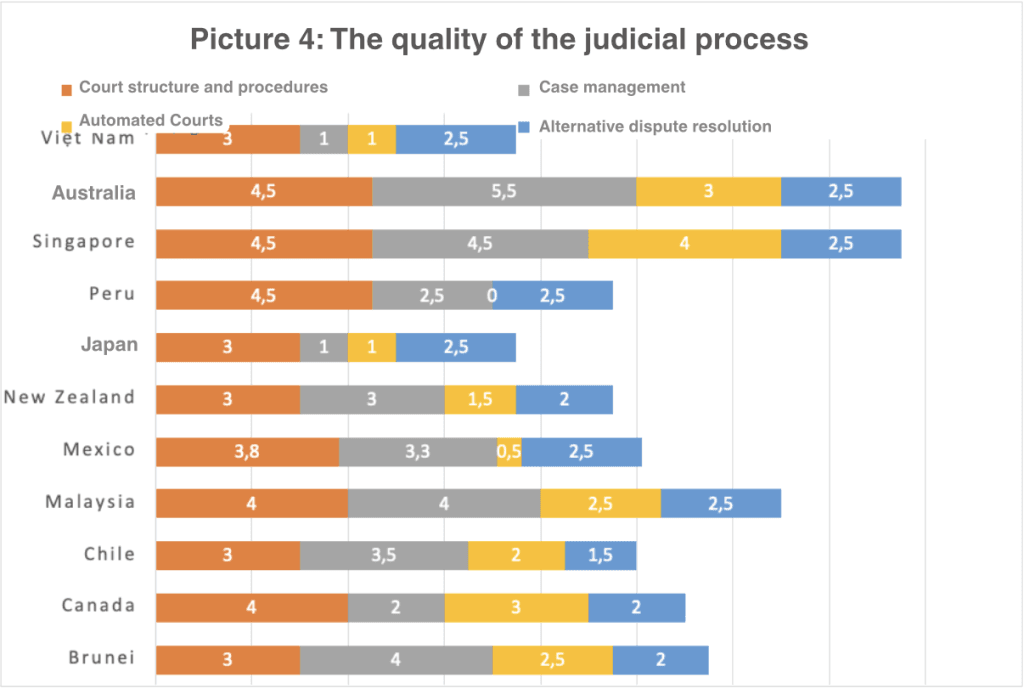

c. Quality of the Judicial Process

The Quality of the Judicial Processes Index is a composite measure of court structure and procedures, case management, automated courts, and alternative dispute resolution. Singapore and Australia jointly lead the way in the quality of the judicial process index (15.5 out of 18). Vietnam and Japan are the two countries with the lowest quality of the judicial process among the CPTPP countries (7.5 out of 18) (see Picture 4).

The “Court Structure and Procedures” index assesses five issues of the court system: (i) specialized commercial courts; (ii) courts for small-value disputes and/or expedited procedures for small-value disputes; (iii) defendants’ movable assets being frozen before trial; (iv) new cases being randomly and automatically assigned to judges; and (v) women’s testimony in court has the same evidentiary weight as men’s testimony. Vietnam scored 3 out of 5 points for the Court Structure and Procedural Procedures index, equal to the other four countries and the lowest score compared to other CPTPP members. As analyzed above, Vietnam does not have a mechanism to resolve small-value disputes. In addition, the random assignment of new cases to judges is not thorough and still has certain and unclear conditions, leading to the process still taking a long time and being difficult to predict[1].

For the “Case Management” index, this index assesses six issues of the court records management system, including: (i) regulations on time limits in the litigation process; (ii) Regulations on suspension, temporary suspension of case settlement and resumption of litigation; (iii) Measures to evaluate litigation activities; (iv) allowing pre-trial agreements between the parties; (v) having an electronic case management system for judges; and (vi) having an electronic case management system for lawyers. Vietnam only scored 1 out of 6 points in this index thanks to regulations on time limits in the litigation process, while most of the remaining CPTPP member countries scored quite high in the Case Management index (from 2 to 5.5 out of 6 points), except for Japan, which scored the same as Vietnam.

For the “Automated Court” index, four issues are assessed: (i) allowing the filing of lawsuits electronically; (ii) having an online, electronic application processing system; (iii) court fees can be paid electronically; and (iv) judgments are widely published. Vietnam ranked 8th among CPTPP members with 1 point (publicizing judgments in commercial cases at all levels of the court online). This is also the most recent reform of Vietnam recorded in the 2019 BCMTKD. For other CPTPP members, only Peru does not have an automated court. However, Vietnam has a low score on “Automated Court” compared to other CPTPP members but is equivalent to Japan and higher than Mexico. In recent years, many countries in the CPTPP have reformed the two indicators “Case Management” and “Automated Courts” by focusing on a number of specific issues, such as having measures to assess litigation activities (Brunei), building an electronic case management system (Brunei), an electronic filing system (Brunei, Canada, Chile, Malaysia), launching a platform that allows electronic payment of court fees (Brunei, Canada), an electronic litigation system (Singapore)…

Finally, the “Alterative Dispute Resolution” index assesses two issues: (i) there is a legal provision on commercial arbitration, all disputes can be brought to arbitration and valid arbitration clauses are usually enforced by the court; and (ii) there is voluntary mediation and/or mediation is a recognized method to resolve commercial disputes, prescribed by law and there are financial incentives for parties to try to conciliate. CPTPP members have quite similar scores, from 2 to 2.5 points (except Chile, which only scored 1.5 points due to no data recording the method of mediation). This index of Vietnam is very high (2.5 out of 3 points), along with six other member countries with high scores. The only criterion that makes Vietnam not achieve the maximum score is financial incentives for parties trying to mediate (such as refunding court filing fees, income tax, etc. if mediation is successful)[2]. This issue is not met by all remaining members of the CPTPP. However, the quality of dispute resolution activities by the alternative method in the CTTPP members is different (specific analysis in Section 2 in the following article).

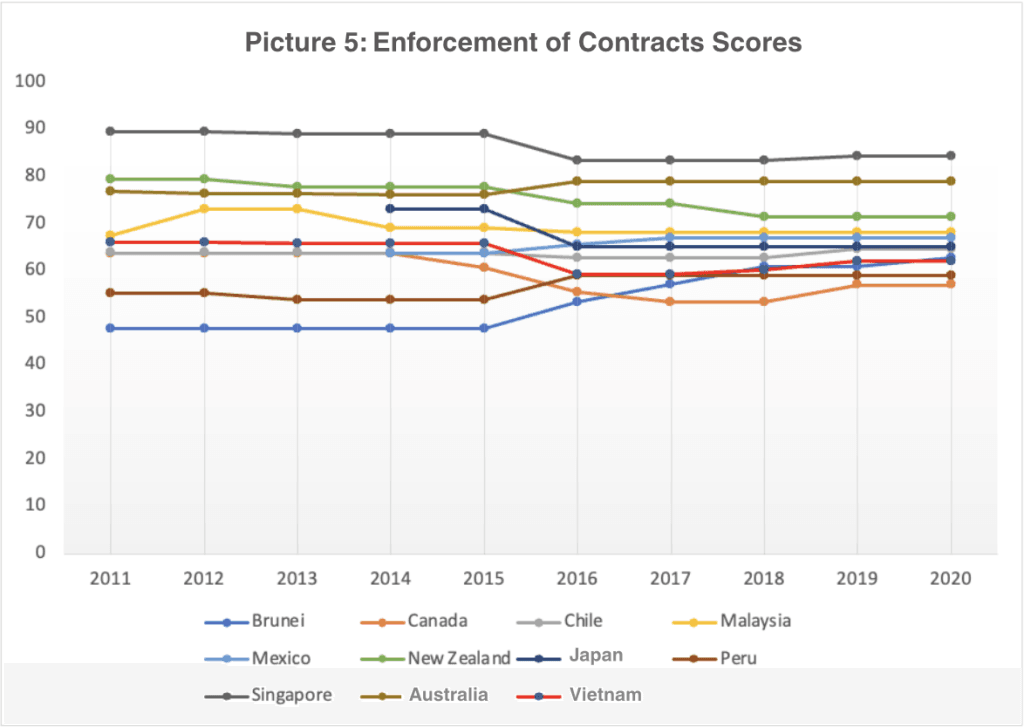

d. Comparing Court Reforms Among CPTPP Members

To promote economic development, countries need to pay attention to improving the quality of judicial activities to promote investment and trade activities[3]. CPTPP members have also made many changes to the court system and institutions related to contract enforcement in the past 10 years (see Picture 5).

In recent years, Brunei has focused on improving two indicators. The first is the “Case Management” indicator by publishing performance measurement reports[4], implementing an electronic case management system for judges and lawyers to use[5]. The second is the “Automated Court” indicator through platforms and systems that allow electronic filing and payment of court fees[6]. As a result, Brunei’s two indicators are quite high and are among the top 5 CPTPP member countries with the highest scores.

Canada has reformed its Enforcement of Contracts index (specifically the “Automated Courts” index) twice. The first time was in 2009-2010, Canada expanded the electronic filing process and simplified judicial administrative procedures[7]. Nearly ten years later, Canada developed an electronic system that allows for the filing of lawsuits and payment of court fees[8]. According to the BCMTKD 2020, Canada has risen to third place in the CPTPP countries’ Automated Courts index. However, due to the lack of improvement in other indicators, Canada’s Enforcement of Contracts score and ranking are at the bottom of the CPTPP.

Chile has reformed its Enforcement of Contracts index only once, through the increase in the “Automated Courts” index (the introduction of an electronic system that allows for the filing of lawsuits electronically) in 2018/19[9].

Malaysia has been interested in improving the “Automated Courts” index early on and has allowed electronic filing of lawsuits since 2010/11[10]. Prior to this, Malaysia has also undertaken a series of reforms in the “Case Management” index (increasing the number of court staff, strictly enforcing deadlines for processing documents) and the “Court Structure and Procedures” index (reorganizing commercial courts to allow for faster resolution of mediation issues)[11]. Malaysia is a good example of judicial and administrative reforms. These reforms have reduced the time to resolve disputes within 10 (ten) years (2007-2018) from 600 days to 425 days (see Figure 2). Together with other reforms, Malaysia’s current ranking in Contract Dispute Resolution is 42nd (higher than Vietnam’s 68th)[12].

Despite a number of policies to improve the business environment, Mexico improved its “Court Structure and Procedures” index only once in 2012/13, thanks to the establishment of small claims courts with oral proceedings that can hear both civil and commercial cases[13].

Before 2015, New Zealand had improved its Enforcement of Contracts index twice (specifically “Case Management”), thanks to the introduction of new district court rules[14] and improvements to its case management system[15]. However, New Zealand took a major step back in the “Court Structure and Procedures” index when it suspended the bringing of new commercial cases to the New Zealand High Court while the new Commercial Tribunal was established[16]. It is the only CPTPP member to have implemented reforms that make it more difficult to enforce contracts in its country, according to BCMTKD data over the years.

Starting in 2008/09, Peru introduced deadlines for the submission of evidence, an appeals procedure, and allowed for electronic submission of judicial notices instead of publication in the official gazette[17]. This is the only “Case Management” reform of Peru noted by BCMTKD. In addition, Peru has also introduced requirements for the selection of judges in commercial courts who must have in-depth knowledge of business law, finance, and capital markets[18]. Among CPTPP members, Singapore can be considered the leading economy in contract enforcement in general and dispute resolution in particular. Singapore has previously implemented a new electronic litigation system to streamline litigation procedures[19].

In 2017, Vietnam made many good reforms to make contract enforcement easier through the application of the new Civil Procedure Code and the issuance of Decree 22/2017/ND-CP on Commercial Mediation[20]. Although it has not signed the Convention, Vietnam has sent representatives to participate in the negotiations of the Singapore Convention on Mediation as an observer. Many seminars and studies on the possibility of Vietnam joining the Singapore Convention on Mediation have been organized by relevant state agencies. Recently, Vietnam continued to reform the “Automated Court” index by publicly publishing commercial judgments at all levels online[21].

It can be seen that CPTPP member countries are mainly interested in improving the “Automated Court” and “Case Management” indices. Most reforms are aimed at simplifying and automating litigation procedures. Japan and Australia did not record any reforms related to Contract Enforcement according to the annual reports of the BCMTKD[22]. However, these two countries still have quite high Contract Enforcement indices (in particular, Australia ranked sixth out of 190 economies surveyed in the BCMTKD 2020).

(To be continued)

*About the Authors:

Lawyer Nguyen Hung Quang – President of Vietnam International Commercial Mediation Center (VICMC)

Nguyen Tran Lan Huong – Member of the Secretariat of Vietnam International Commercial Mediation Center (VICMC)

[1] Nguyen Hung Quang – Tran Van Do, Comparative analysis report on mechanisms to ensure judicial integrity to promote business in some countries and lessons for Vietnam, Central Internal Affairs Committee – UK Government – United Nations Development Program, pp. 70-71, 2020.

[2] The World Bank Group, Doing Business 2020: Economy Profile Vietnam, pp. 55, 2019.

[3] Montesquieu mentioned in the book “The Spirit of Law” and Adam Smith in the book “An inquiry into the Nature and Causes of the Weath of Nations”.

[4] The World Bank Group, Doing Business 2020, 2019.

[5] The World Bank Group, Doing Business 2018, 2017.

[6] The World Bank Group, Doing Business 2017, 2016.

[7] The World Bank Group, Doing Business 2011, 2010.

[8] The World Bank Group, Doing Business 2019, 2018.

[9] The World Bank Group, Doing Business 2019, 2018.

[10] The World Bank Group, Doing Business 2012, 2011.

[11] The World Bank Group, Doing Business 2010, 2009.

[12] Nguyen Hung Quang, Business needs for the Court’s activities to ensure contract enforcement in Vietnam, p. 6, USAID – Governance for Inclusive Growth Project, 2018.

[13] The World Bank Group, Doing Business 2014, 2013.

[14] The World Bank Group, Doing Business 2011, 2010.

[15] The World Bank Group, Doing Business 2014, 2013.

[16] The World Bank Group, Doing Business 2018, 2017.

[17] The World Bank Group, Doing Business 2010, 2009.

[18] The World Bank Group, Doing Business 2019: Enforcing Contracts and Resolving Insolvency: Training and efficiency in the judicial system, tr. 55, 2018.

[19] The World Bank Group, Doing Business 2015, 2014.

[20] The World Bank Group, Doing Business 2018, 2017.

[21] The World Bank Group, Doing Business 2019, 2018.

[22] The World Bank Group, Doing Business 2020: Economy Profile Japan, tr. 116,2019; The World Bank Group, Doing Business 2020: Economy Profile Australia, tr. 66, 2019.